Is Your Current Agency Making You Money? Rethinking How We Measure Marketing Success

Is Your Current Agency Making You Money? Rethinking How We Measure Marketing Success

Is Your Current Agency Making You Money? Rethinking How We Measure Marketing Success

Is Your Current Agency Making You Money? Rethinking How We Measure Marketing Success

How To Track Marketing Agency ROI

How To Track Marketing Agency ROI

How To Track Marketing Agency ROI

How To Track Marketing Agency ROI

Danny Sapio

Digital Marketing

Digital Marketing

February 2, 2024

February 2, 2024

11

11

min read

min read

The intricate nature of user journeys can make it challenging to directly link every marketing activity to a clear outcome. However, when you're investing a substantial portion of your budget in a marketing agency, it’s crucial to ensure that your spending translates into meaningful results.

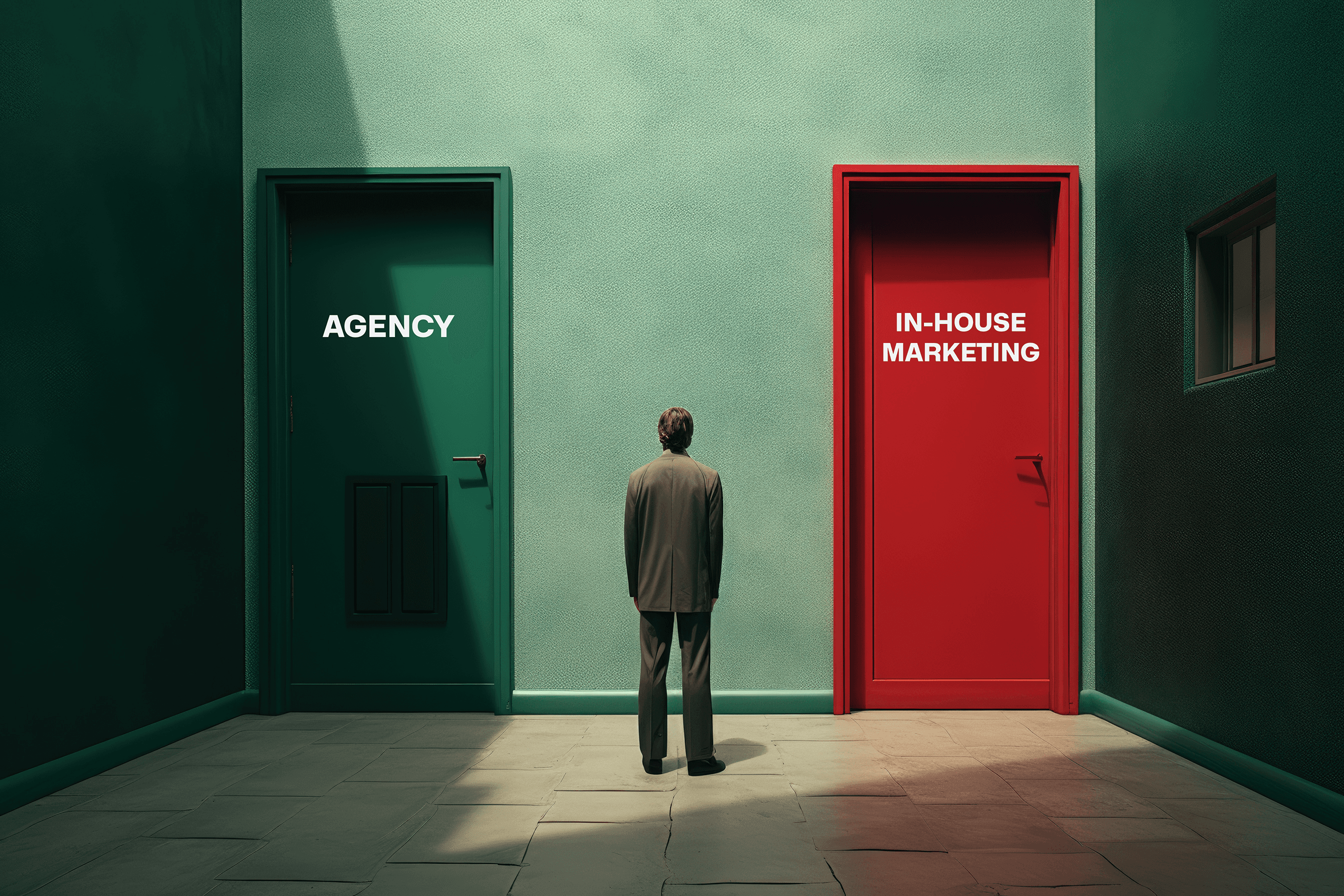

Many agencies, to minimize risk, often resort to measuring success through vanity metrics like keyword rankings or ad clicks. While not entirely irrelevant, these metrics alone aren't the best indicators of an agency’s true value. Vanity metrics can offer insights, but they rarely reflect the whole picture.

Why is that? Because these metrics don’t always correlate with revenue growth.

Even if your marketing agency's reports indicate an improving strategy, this may not align with what truly matters to your business—actual growth in closed-won revenue, as reported by your finance team. When marketing reports are out of sync with financial reports, it becomes harder to gain stakeholder buy-in for future marketing initiatives.

To address this, we employ a system that ties the buyer's journey to real closed revenue, ensuring that your marketing efforts directly contribute to tangible business outcomes. In this post, we’ll walk you through the process we use to align closed-won revenue with marketing activities, and how you can implement a similar reporting structure to measure your strategy’s success accurately.

By using this approach, you’ll be able to calculate the ROI of your marketing agency more precisely and better align with stakeholders, ultimately securing budget approval for future campaigns.

Moving Beyond Marketing Metrics

Our Predictable Growth Methodology is built around one primary goal for our partners: making them unstoppable. This approach doesn’t just focus on optimizing marketing efforts but on driving outcomes that empower the entire organization.

Unlike many agencies that measure success solely at the marketing level, we focus on how marketing contributes to business growth. While marketing performance is important, we place equal emphasis on generating the right volume and quality of pipeline for the sales team to help the business acquire the right customers and meet its goals.

When we start working with clients, one of our first priorities is understanding how much a customer is worth to them and identifying how marketing efforts contribute to closed deals. We don’t just look at marketing-qualified leads (MQLs) or pipeline opportunities, though those are important. We focus on the actual dollars earned from closed-won revenue.

Why? Because anything short of closed-won revenue is not yet tangible ROI. A growing pipeline can be a positive sign, but if those opportunities don’t convert into paying customers, they hold little value at the business level. Predictable growth and investment justification can’t rely on projected revenue alone.

Defining the Value of a Closed-Won Deal

Before we build a reporting model, we define the value of a closed deal, which can vary based on the customer lifecycle.

For example, if a trial converts into a $49 monthly subscription, does that mean the customer is only worth $49? Likely not, unless they churn after 30 days, which suggests a more significant issue with your marketing or product.

To define the value of a closed deal, we ask a few key questions:

Should we use the deal size? : This is useful if the customer pays for their entire lifetime value upfront. But if they’re on a monthly or annual plan, that’s only a fraction of their actual lifetime value.

Should we use Annual Contract Value (ACV)? : ACV offers a good measure of the customer’s value over the term of their annual contract or your yearly financials. But if customers typically renew and stay with you for five years, you’re only measuring a portion (20% in this case) of their total value.

In most cases, we use lifetime value (LTV) for a more accurate measure of a customer’s worth, as long as they continue paying. To refine this further, we may incorporate churn metrics for Gross Revenue Retention (GRR) or Net Revenue Retention (NRR). For simplicity, though, we'll focus on LTV here.

Why We Use LTV

Many companies rely on monthly or quarterly reports to measure marketing ROI, but this method is inaccurate for enterprise B2B SaaS businesses for two key reasons:

Total Revenue vs. Initial Contract Value: The total revenue from a new enterprise client is often much higher than the initial contract. For instance, a $100,000 contract over 12 months could result in $300,000 in total revenue if the client stays for three years. Measuring ROI based only on the initial contract value doesn’t capture the real return on your marketing investment.

Long Sales Cycles: Enterprise B2B buying cycles often span multiple quarters, making it difficult to attribute a single deal solely to the marketing efforts of that month or quarter. The buyer journey typically starts months earlier, so attributing success to a specific time frame can be misleading.

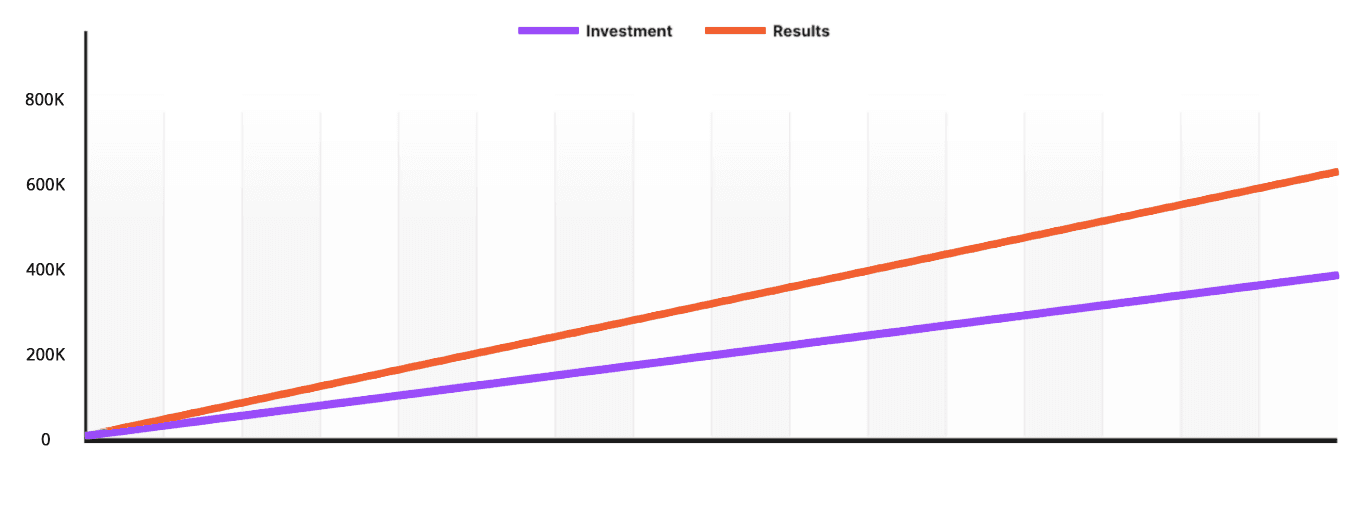

By using LTV, we capture the true return on your marketing dollars, holding the agency accountable for long-term success rather than just short-term wins. Our Predictable Growth Methodology is designed to provide cumulative, long-term value, building a strong foundation for predictable ROI growth over several years.

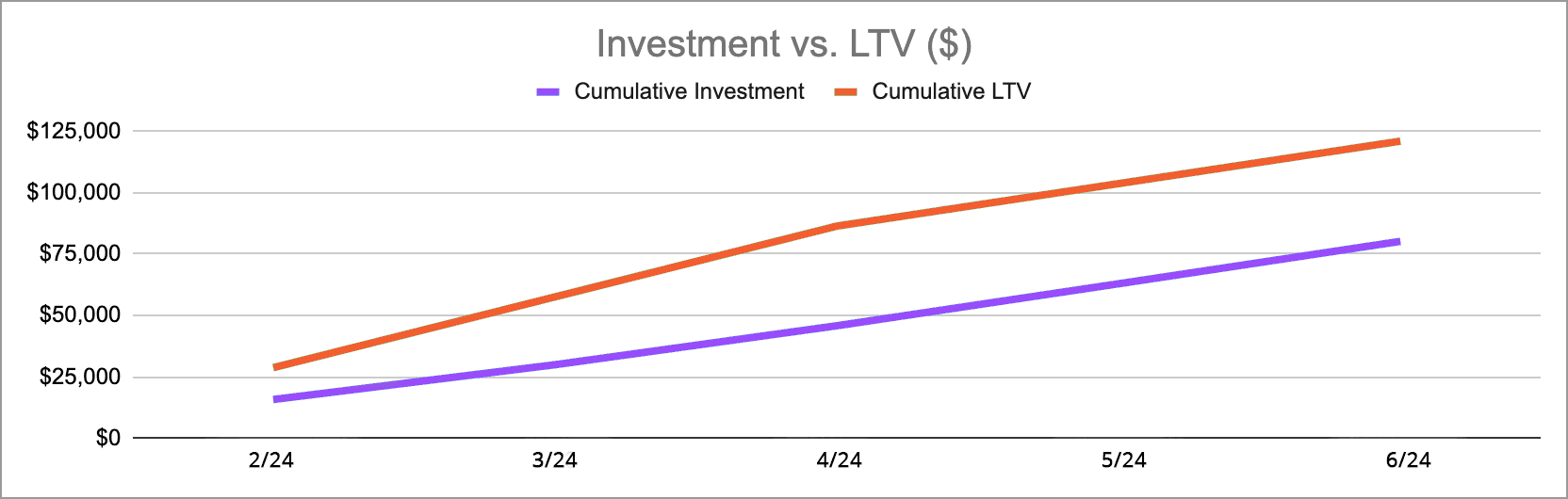

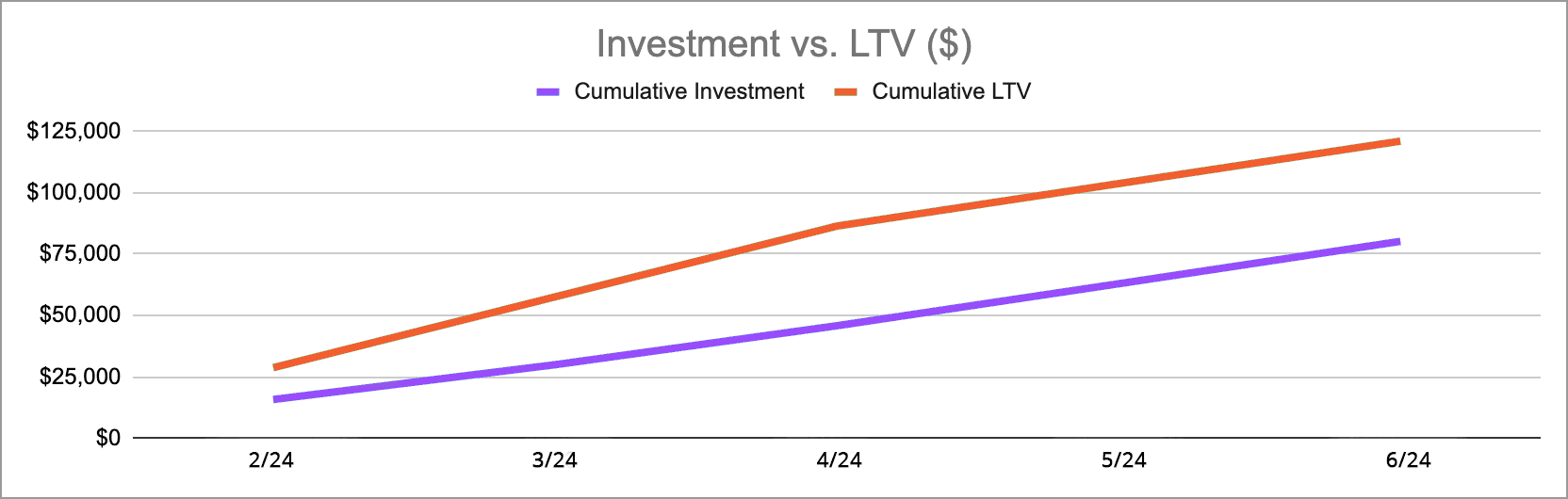

What Our ROI Reports Look Like

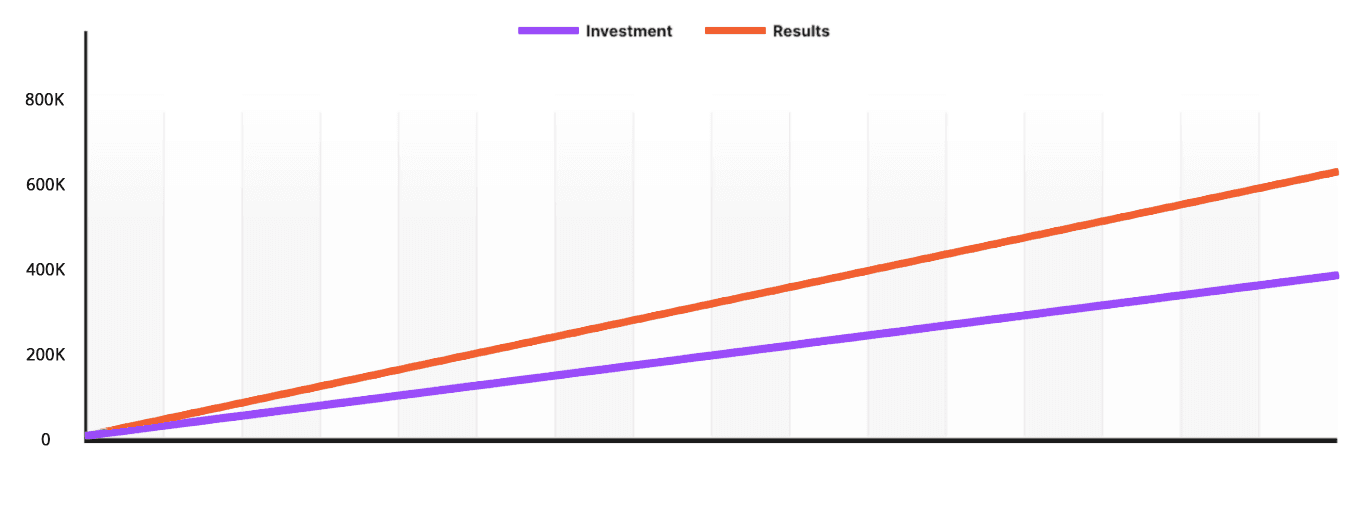

Our reports are visually straightforward, allowing clients to see, at a glance, how their marketing investment has translated into revenue growth over time. We intentionally avoid overwhelming stakeholders with complex financial data; instead, we focus on showing the directional ROI of their marketing strategy.

Yes, we still track critical metrics like Customer Acquisition Cost (CAC), payback periods, and churn rates. However, these are secondary to the overarching question: What’s the ROI of our marketing investment over the past X years?

We answer this by presenting a simple graph showing closed-won revenue. Our goal is to ensure that this line shows compounding growth year over year.

Building the ROI Report

To build an effective ROI report, it’s crucial that all stakeholders are working from the same data set. Our first step is to assess how you’re currently measuring marketing performance, revenue performance, and the pipeline metrics in between.

If we were to only ask for access to a client’s reports and draw our own conclusions, it would be a complicated, time consuming endeavor that could lead to misalignment. To avoid this risk, we co-create these reports with our clients.

We’ll have a series of conversations and workshops to understand how and why they measure these metrics so we can learn from their experience.

Rather than drawing conclusions from existing reports, we co-create these reports with our clients, engaging in conversations and workshops to align our understanding. This ensures that everyone is on the same page, and we’re all working from a shared source of truth.

For example, when we begin working with a client, we assess their ability to track marketing, sales, and revenue performance holistically. If there are gaps in their tracking systems, our priority is to diagnose and address them. We also verify that their data is clean and accurate.

Once proper reporting is in place, we can answer questions like:

What’s the value of an average customer?

What’s the LTV of your customer?

Starting with these questions, rather than focusing on vanity metrics, allows us to accurately attribute closed-won revenue to marketing efforts.

Calculating Marketing ROI

Once you have clean data and reporting set up, calculating ROI becomes straightforward. We measure closed-won revenue generated directly from marketing efforts and align it with the actual dollars landing in the company’s bank account. We then calculate the total investment based on the cost of engagement.

The formula is simple:

ROI (%)= REVENUE-INVESTMENT/INVESTMENT x 100

For example, if a client generates $200,000 in revenue over a year and invests $150,000 in marketing, the ROI is 133%, meaning they earned $1.33 for every $1 spent. This formula ensures alignment with your finance team’s records, providing an objective assessment of your marketing strategy’s success.

What Constitutes a Healthy ROI?

The next question often asked is: What is a healthy ROI? The answer varies depending on factors like:

The maturity of your marketing and business—are you primed to scale or still building a foundation?

Industry-specific unit economics, such as buying cycles and pricing models.

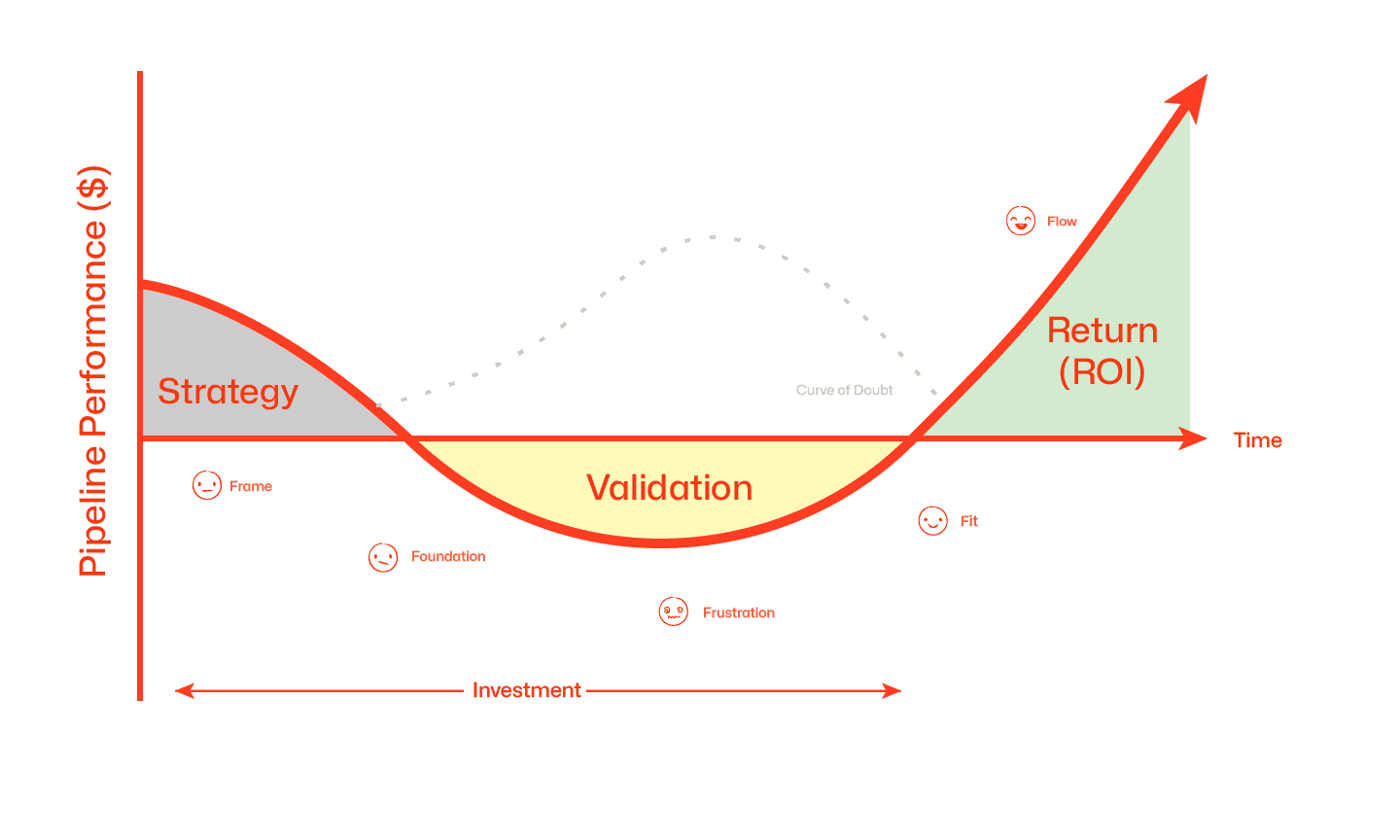

The stage of your journey with your marketing agency.

Most agencies use industry benchmarks to gauge ROI, but this can be misleading for two reasons:

Each company has a unique starting point. Businesses with more established marketing programs are more likely to see a strong ROI right away, whereas those still building may fall behind industry benchmarks.

Short-term ROI doesn’t always correlate with long-term success. Agencies might use growth hacks to boost short-term conversions, but these may not generate sustained growth, especially for businesses with longer buying cycles.

As a result, you’ll just waste money.

Instead, we look at the full customer journey and focus on improving each stage of the journey. As a result, our efforts improving the top of the funnel may not produce an ROI until 12 or 18 months later when those leads are finally ready to convert.

Yet over a longer time horizon, you’ll see that this strategy is actually much more effective and sustainable than those focusing on short term growth strategies to keep up with industry benchmarks.

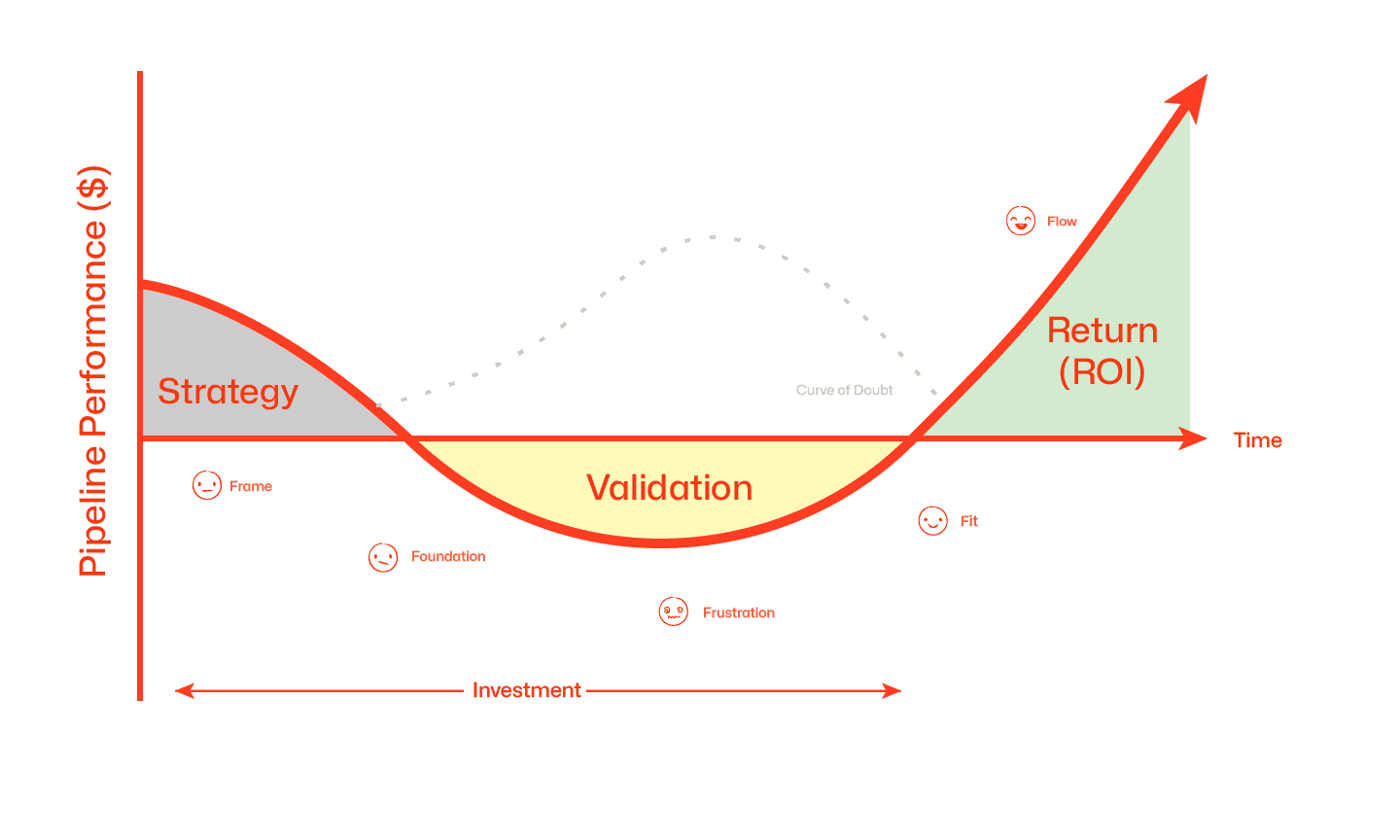

The fact is that our partnerships with our clients are collaborative journeys that ebb and flow over time. “Instant results” is a wonderful promise but that’s rarely the reality.

Typically our first year with clients has high periods, where we see quick results after tackling low hanging fruit, and low periods where there’s doubt as we’re testing to identify what works. This is normal and we’ve covered this topic of what it’s realistically like working with a marketing agency.

However, if the ROI is negative, we don’t make wild or crazy bets to turn it around.

Instead, we look at what aspects of the strategy are working and then double down on those and cut channels and campaigns that are ineffective.

This approach reduces risk as we’re just refocusing your efforts on what’s already working rather than randomly guessing and testing new approaches.

Start Measuring Marketing Revenue Accurately

If your revenue trends aren’t aligning with your marketing strategy, consider using the LTV model to measure success more effectively. If you need help implementing this system, reach out to our team at Blend. We focus exclusively on long-term growth, and we’re here to help you create a plan for sustained success.

The intricate nature of user journeys can make it challenging to directly link every marketing activity to a clear outcome. However, when you're investing a substantial portion of your budget in a marketing agency, it’s crucial to ensure that your spending translates into meaningful results.

Many agencies, to minimize risk, often resort to measuring success through vanity metrics like keyword rankings or ad clicks. While not entirely irrelevant, these metrics alone aren't the best indicators of an agency’s true value. Vanity metrics can offer insights, but they rarely reflect the whole picture.

Why is that? Because these metrics don’t always correlate with revenue growth.

Even if your marketing agency's reports indicate an improving strategy, this may not align with what truly matters to your business—actual growth in closed-won revenue, as reported by your finance team. When marketing reports are out of sync with financial reports, it becomes harder to gain stakeholder buy-in for future marketing initiatives.

To address this, we employ a system that ties the buyer's journey to real closed revenue, ensuring that your marketing efforts directly contribute to tangible business outcomes. In this post, we’ll walk you through the process we use to align closed-won revenue with marketing activities, and how you can implement a similar reporting structure to measure your strategy’s success accurately.

By using this approach, you’ll be able to calculate the ROI of your marketing agency more precisely and better align with stakeholders, ultimately securing budget approval for future campaigns.

Moving Beyond Marketing Metrics

Our Predictable Growth Methodology is built around one primary goal for our partners: making them unstoppable. This approach doesn’t just focus on optimizing marketing efforts but on driving outcomes that empower the entire organization.

Unlike many agencies that measure success solely at the marketing level, we focus on how marketing contributes to business growth. While marketing performance is important, we place equal emphasis on generating the right volume and quality of pipeline for the sales team to help the business acquire the right customers and meet its goals.

When we start working with clients, one of our first priorities is understanding how much a customer is worth to them and identifying how marketing efforts contribute to closed deals. We don’t just look at marketing-qualified leads (MQLs) or pipeline opportunities, though those are important. We focus on the actual dollars earned from closed-won revenue.

Why? Because anything short of closed-won revenue is not yet tangible ROI. A growing pipeline can be a positive sign, but if those opportunities don’t convert into paying customers, they hold little value at the business level. Predictable growth and investment justification can’t rely on projected revenue alone.

Defining the Value of a Closed-Won Deal

Before we build a reporting model, we define the value of a closed deal, which can vary based on the customer lifecycle.

For example, if a trial converts into a $49 monthly subscription, does that mean the customer is only worth $49? Likely not, unless they churn after 30 days, which suggests a more significant issue with your marketing or product.

To define the value of a closed deal, we ask a few key questions:

Should we use the deal size? : This is useful if the customer pays for their entire lifetime value upfront. But if they’re on a monthly or annual plan, that’s only a fraction of their actual lifetime value.

Should we use Annual Contract Value (ACV)? : ACV offers a good measure of the customer’s value over the term of their annual contract or your yearly financials. But if customers typically renew and stay with you for five years, you’re only measuring a portion (20% in this case) of their total value.

In most cases, we use lifetime value (LTV) for a more accurate measure of a customer’s worth, as long as they continue paying. To refine this further, we may incorporate churn metrics for Gross Revenue Retention (GRR) or Net Revenue Retention (NRR). For simplicity, though, we'll focus on LTV here.

Why We Use LTV

Many companies rely on monthly or quarterly reports to measure marketing ROI, but this method is inaccurate for enterprise B2B SaaS businesses for two key reasons:

Total Revenue vs. Initial Contract Value: The total revenue from a new enterprise client is often much higher than the initial contract. For instance, a $100,000 contract over 12 months could result in $300,000 in total revenue if the client stays for three years. Measuring ROI based only on the initial contract value doesn’t capture the real return on your marketing investment.

Long Sales Cycles: Enterprise B2B buying cycles often span multiple quarters, making it difficult to attribute a single deal solely to the marketing efforts of that month or quarter. The buyer journey typically starts months earlier, so attributing success to a specific time frame can be misleading.

By using LTV, we capture the true return on your marketing dollars, holding the agency accountable for long-term success rather than just short-term wins. Our Predictable Growth Methodology is designed to provide cumulative, long-term value, building a strong foundation for predictable ROI growth over several years.

What Our ROI Reports Look Like

Our reports are visually straightforward, allowing clients to see, at a glance, how their marketing investment has translated into revenue growth over time. We intentionally avoid overwhelming stakeholders with complex financial data; instead, we focus on showing the directional ROI of their marketing strategy.

Yes, we still track critical metrics like Customer Acquisition Cost (CAC), payback periods, and churn rates. However, these are secondary to the overarching question: What’s the ROI of our marketing investment over the past X years?

We answer this by presenting a simple graph showing closed-won revenue. Our goal is to ensure that this line shows compounding growth year over year.

Building the ROI Report

To build an effective ROI report, it’s crucial that all stakeholders are working from the same data set. Our first step is to assess how you’re currently measuring marketing performance, revenue performance, and the pipeline metrics in between.

If we were to only ask for access to a client’s reports and draw our own conclusions, it would be a complicated, time consuming endeavor that could lead to misalignment. To avoid this risk, we co-create these reports with our clients.

We’ll have a series of conversations and workshops to understand how and why they measure these metrics so we can learn from their experience.

Rather than drawing conclusions from existing reports, we co-create these reports with our clients, engaging in conversations and workshops to align our understanding. This ensures that everyone is on the same page, and we’re all working from a shared source of truth.

For example, when we begin working with a client, we assess their ability to track marketing, sales, and revenue performance holistically. If there are gaps in their tracking systems, our priority is to diagnose and address them. We also verify that their data is clean and accurate.

Once proper reporting is in place, we can answer questions like:

What’s the value of an average customer?

What’s the LTV of your customer?

Starting with these questions, rather than focusing on vanity metrics, allows us to accurately attribute closed-won revenue to marketing efforts.

Calculating Marketing ROI

Once you have clean data and reporting set up, calculating ROI becomes straightforward. We measure closed-won revenue generated directly from marketing efforts and align it with the actual dollars landing in the company’s bank account. We then calculate the total investment based on the cost of engagement.

The formula is simple:

ROI (%)= REVENUE-INVESTMENT/INVESTMENT x 100

For example, if a client generates $200,000 in revenue over a year and invests $150,000 in marketing, the ROI is 133%, meaning they earned $1.33 for every $1 spent. This formula ensures alignment with your finance team’s records, providing an objective assessment of your marketing strategy’s success.

What Constitutes a Healthy ROI?

The next question often asked is: What is a healthy ROI? The answer varies depending on factors like:

The maturity of your marketing and business—are you primed to scale or still building a foundation?

Industry-specific unit economics, such as buying cycles and pricing models.

The stage of your journey with your marketing agency.

Most agencies use industry benchmarks to gauge ROI, but this can be misleading for two reasons:

Each company has a unique starting point. Businesses with more established marketing programs are more likely to see a strong ROI right away, whereas those still building may fall behind industry benchmarks.

Short-term ROI doesn’t always correlate with long-term success. Agencies might use growth hacks to boost short-term conversions, but these may not generate sustained growth, especially for businesses with longer buying cycles.

As a result, you’ll just waste money.

Instead, we look at the full customer journey and focus on improving each stage of the journey. As a result, our efforts improving the top of the funnel may not produce an ROI until 12 or 18 months later when those leads are finally ready to convert.

Yet over a longer time horizon, you’ll see that this strategy is actually much more effective and sustainable than those focusing on short term growth strategies to keep up with industry benchmarks.

The fact is that our partnerships with our clients are collaborative journeys that ebb and flow over time. “Instant results” is a wonderful promise but that’s rarely the reality.

Typically our first year with clients has high periods, where we see quick results after tackling low hanging fruit, and low periods where there’s doubt as we’re testing to identify what works. This is normal and we’ve covered this topic of what it’s realistically like working with a marketing agency.

However, if the ROI is negative, we don’t make wild or crazy bets to turn it around.

Instead, we look at what aspects of the strategy are working and then double down on those and cut channels and campaigns that are ineffective.

This approach reduces risk as we’re just refocusing your efforts on what’s already working rather than randomly guessing and testing new approaches.

Start Measuring Marketing Revenue Accurately

If your revenue trends aren’t aligning with your marketing strategy, consider using the LTV model to measure success more effectively. If you need help implementing this system, reach out to our team at Blend. We focus exclusively on long-term growth, and we’re here to help you create a plan for sustained success.

Written by

Danny Sapio

When not hard at work, Danny can be found enjoying the outdoors, seeing live music, and exercising. Danny is passionate about data-informed decisions and strongly believes in implementing cohesive measurement frameworks to ensure all media is accountable for driving business outcomes. Throughout his career, he has developed full-funnel media strategies to drive both Brand Awareness and Growth objectives. He also loves ideating and activating first-to-market opportunities for clients to help brands stay innovative and at the forefront of their vertical.

More articles by

Danny Sapio

You might also like…

+91 6366 298 298

+91 6366 298 298

+91 6366 298 298

+91 6366 298 298

+91 6366 298 298